The wisdom of the crowd

We're looking for relatively quick returns to reach our (some might say crazy) target of being financially independent in 199 days, so exploring alternative investment opportunities is a very important part of how to get there. Even with the wonders of compounding, the relatively low interest on traditional savings aren't going to cut it. Similarly, while traditional investments like sticks and funds will likely offer the chance of much oarger returns, they bring with them other forms of risk. So, what about alternative investments? Is there something that surpasses the returns of savings accounts, but offers some diversity of risk from the stock market? Bonds might be an option, but liquidity comes into play if we venture into this space (not that its off the table, I'm sure we'll return to it later). So what about the up and coming alternative investment options? No, not blockchain, even we're not that [stupid | desparate | optimistic] (delete as appropriate). We're talking about crowd-investment vehicles, such as crowdfunded personal and business loans; venture investment opportunities; crowd property investments. There are a growing number of providers out there that offer ways to invest small or large amounts of money which is then matched to appropriate borrowers or opportunities (either automatically, or you can pick and choose) at a seemingly competitive rate of return, often with reasonable liquidity through secondary markets. Let's look at the options.

Crowd Funded Venture Opportunities

So many platforms are springing up to get in on the startup culture and help fund the next big thing. Whether that's the now 'elder statesman' and more well known operations like Kickstarter or Indigogo, or the lesser known players like CrowdCube.

While interesting as a more longer-term, speculative play, the likelihood of these showing any shorter-term or predictable returns are pretty slim, so we;re largely discuounting them from our current exercises. We may revisit them at a later date, or take a small punt on something just so we can follow through the process, but for for our immediate focus, they don't seem lie the best fit.

Crowd Funded Property Investments

Property is always a good investment (or so I'm told - I'm sure we'll validate that over the coming weeks and months), so platforms like BrickInvest that allow you to gain some exposure to property investment without having to go full-on into the development or rental markets look like an appealing option. Minimum ionvestment levels are relatively modest; predicted returns are in the high single, low double digits; and there's some liquidity through secondary markets. Definitely one to keep on the list, but might make sense as a more longe term play to take advantage of the asset appreciation that's obviously a key element of property investment.

Crowd Funded Personal and Business Loans

This is probably the area that fits our needs the best. Individuals and Organisations looking for short, mid and long-term funding for various reasons, and exploring optons outside of tradtional banks and financial institutions. There are any number of larger players in this space - RateSetter, Zopa, Lending Crowd, Funding Circle - all offering a similar approach. Individuals or businesses apply; the providers underwriters assess the loan; it's carved up to investors who provide the capital; repayments replenish the investors funds (with interest, obviously) and the cycle continues. Again, liquidity through secondary markets is common across most platforms, and the nature of splitting loans into bitesize chunks across investors limits exposure. Returns tend to be in the mid to high single figure percentage range, when taking into account service fees and predicted bad-debt provisioning.

So, let's do it.

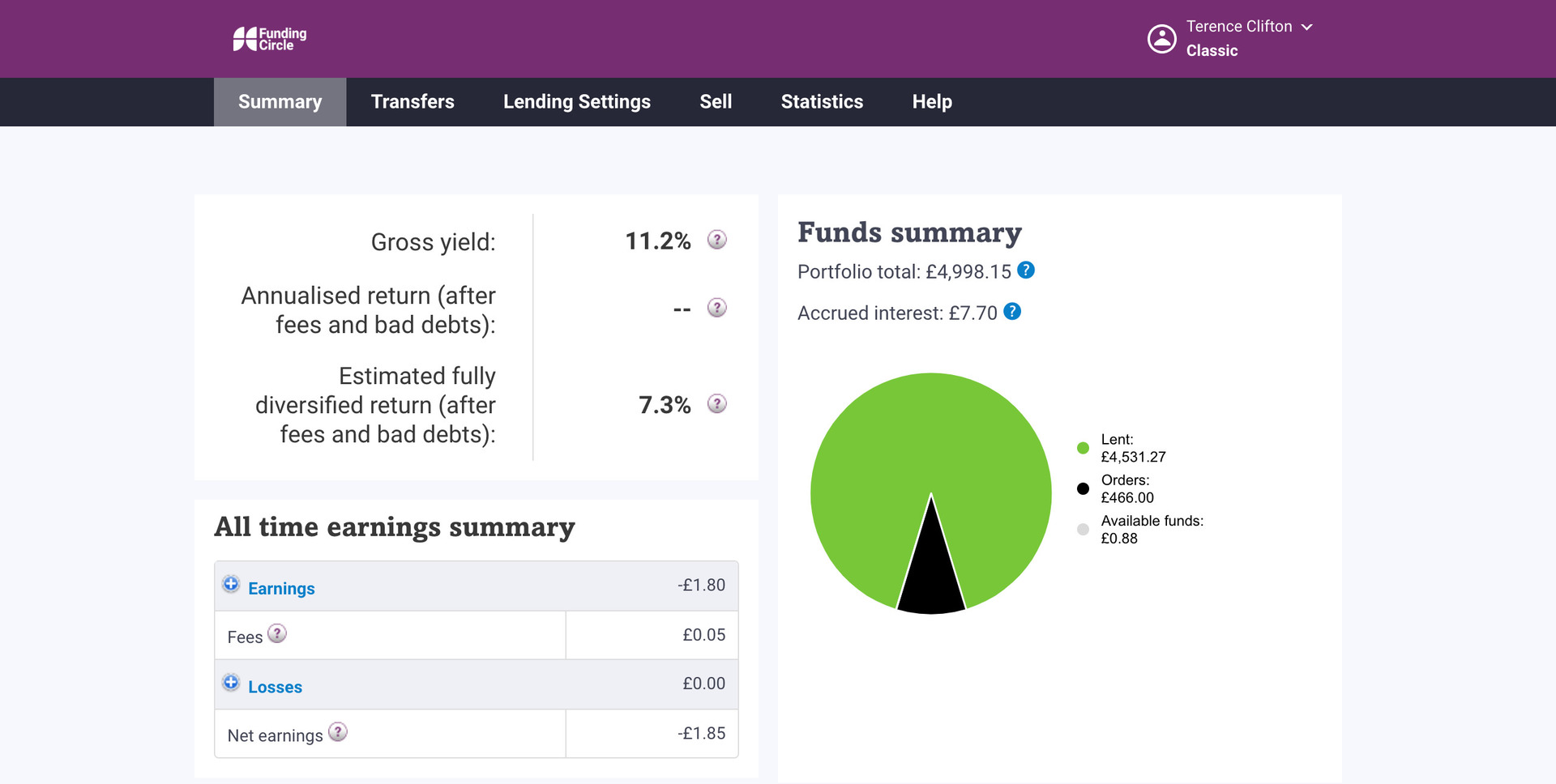

Both the property investment and the crowd-fiunded loan options look relatively appealing in terms of their predicted returns and the simplicity of the process. We see property investment as a more longer term play (and may be a route we take more wholeheartedly when looking at our regular income stream), so for now, we're going to dip our toe into the crowd-funded loan market. Looking at the options here, we decided corporate loans are the way to go (no particular reason - we may experiment with both corporate and private in time), and opted for Funding Circle as our provider of choice. They offer a relatively simple setup (open account, validate account, deposit funds via plastic) and good transparency of who you're lending to (you can see the details of the organisation, the purpose of the loan, and even ask questions of the directors). They also offer their service through an ISA wrapper, so you can take advantage of the tax breaks that offers. We put our hard-earned cash where our proverbial mout was and stumped up £5000 to start the ball rolling:

They offer two lending options (balanced or conservative), based on the amount of risk you're willing to take, and therefore the types of loans and organisations you're willing to service (all based on their own underwriting), We opted for the balanced option, which spreads our overall investment across their risk bands, giving the potential for slightly higher returns - they advertise 6-7% compared to 5-5.5 for the 'conservative' lending option. It took a few days for all of our deposit to be matched to loans (the maximum exposure to one applicant is £25, giving us a 0.5% exposure to any one borrower, which again limits your risk a little. As you can see from the screengrab, they're currently predicting a 7.3% return on the loans theyve matched us to, based on a 11.2% gross yield (bad debt provisioning at their average rate and their service fees - 1% annually). If that plays out, we'll be relatively happy. The process was super simple and for thos of you (like me) that are onstantly checking their investments (even though it's bad for your health, I'm sure), they have an IPhone app where you can see upcoming repayments and varioius other details about your loan parts.

All in, a satisfying way to invest £5k, with seemingly reasonable rate of return - we'll report back as things progress.

“Every school-age kid should be taught about compounding as soon as they can understand it”

Spending Review

Spending Review

More space, less junk. Discuss

More space, less junk. Discuss

Week one recap

Week one recap

Yolt... OK, I can't think of a funny title.

Yolt... OK, I can't think of a funny title.

Everybody loves a good book

Everybody loves a good book